Fresh plans for a lakefront lifestyle often start with questions...

Read MoreAbout Home Improvement All

HomeImprovementAll.com is a comprehensive home improvement blog and knowledge hub dedicated to helping homeowners, renters, and DIY enthusiasts enhance their living spaces through practical, easy-to-understand guidance. The website is packed with valuable content that covers a broad range of topics including home repair tips, routine maintenance checklists, cleaning strategies, interior and exterior design inspiration, HVAC troubleshooting, plumbing basics, and step-by-step DIY project ideas.

Unlike contractor platforms or service directories, HomeImprovementAll.com does not offer bookable services. Instead, it focuses on being a reliable educational resource, empowering individuals to handle their own home-related challenges confidently and cost-effectively. Whether you’re dealing with a leaky faucet, planning a kitchen makeover, organizing your space, or exploring seasonal home care strategies, you’ll find expert-backed articles tailored to your needs.

With regularly updated blog posts, trend-based insights, and user-friendly advice, HomeImprovementAll.com aims to become your trusted go-to site for everything related to home improvement, property upkeep, and smart living.

Property Details

- Room Dimension

- Interior Rooms

- Exterior Rooms

Choosing the right room dimensions is key to creating a functional and comfortable home. Our expert-recommended room sizes ensure optimal space usage for every area—from living rooms and bedrooms to kitchens, bathrooms, and home offices. Whether you’re planning a compact 2BHK or a spacious villa, we help you achieve ideal proportions for better flow, ventilation, and furniture placement.

Upgrade your space with modern interior design that blends minimalism, comfort, and elegance. Our design concepts focus on clean lines, open layouts, neutral color palettes, and smart storage solutions to create interiors that are both stylish and practical. Whether you’re revamping your living room, bedroom, kitchen, or office, we help you achieve a sleek, clutter-free aesthetic that reflects contemporary living.

Explore trending ideas, space-saving layouts, and personalized décor tips for a truly modern home interior

Enhance your home’s curb appeal and functionality with beautifully designed exterior rooms. From cozy balconies, terraces, and verandas to spacious patios, gazebos, and outdoor kitchens, modern exterior spaces are perfect for relaxing, entertaining, or dining al fresco. Our design tips focus on weather-resistant materials, natural lighting, and space optimization to create seamless indoor-outdoor transitions.

Explore inspiring exterior room designs that elevate your outdoor lifestyle while adding value to your home.

Floor Plans

Discover our collection of modern, functional floor plans designed to suit every family size and lifestyle. From 1BHK and 2BHK layouts to spacious 3BHK and villa designs, each plan is created with optimal space usage, natural light flow, and modern living in mind. We also offer custom floor plan solutions tailored to your plot size and preferences—including Vastu-compliant layouts, open-concept designs, and construction-ready blueprints.

Whether you're building your dream home or renovating, explore plans that combine style, comfort, and practicality—all in one place.

Our Blogs

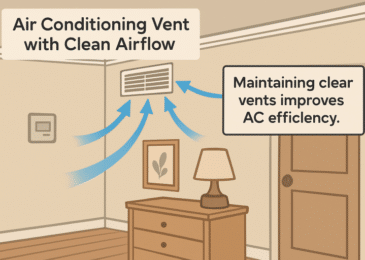

Effortless Tips to Keep Your Air Conditioning Running Smoothly All Year

Table of Contents Schedule Regular Maintenance Replace Air Filters Keep...

Read MoreHelpful Signs It’s Time to Call for Professional Plumbing Service

A home can run smoothly for years until plumbing problems...

Read MoreThe Complete Guide to Choosing the Right Fridge for Rent in Bangalore

A fridge on rent in Bangalore isn’t just an appliance;...

Read MorePro Tips HVAC Near Me Teams Share for Allergy-Friendly Home Setup

Dust doesn’t just settle on shelves—it lingers in the air,...

Read MoreStep-by-Step Guide to Remodeling a Small Bathroom (2025)

Remodeling a small bathroom can seem like a daunting task,...

Read MoreTop Budget-Friendly Home Renovation Hacks for 2025

🏠 Introduction You don’t need a sky-high budget to renovate...

Read More25 Best Home Improvement Ideas to Transform

Whether you’re aiming to boost your home’s resale value or...

Read MoreRevitalize Your Space: Expert Kitchen Remodeling Ideas

Start With a Functional Layout Before selecting cabinets or paint...

Read More